Shares of Amazon, Nvidia, and Tesla fell by nearly 5%, while shares of Alphabet, Google’s parent company, and Meta, the owner of Facebook, dropped by about 2% and 4% respectively. This resulted in a combined market value loss of $770 billion for major tech companies following President Donald Trump’s threats to increase tariffs on Chinese goods.

According to CNBC, as the share of trillion-dollar tech companies in the US market grows, their decline led to a 3.6% drop in the Nasdaq index and a 2.7% decline in the S&P 500 index. This was the worst day for both indices since April, when Trump revealed plans to impose “reciprocal” tariffs on US trading partners.

Trump announced on social media that the US would impose 100% tariffs on China, and starting November 1, export controls would be applied “on all critical software.”

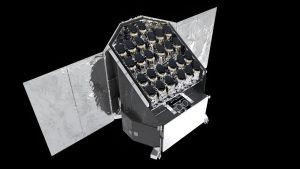

The president’s recent threats disrupted the tech sector’s recovery, which was built on hundreds of billions of dollars in planned spending on AI infrastructure. Nvidia, the manufacturer of graphics processing units used to train AI models, recently became the first company to reach a market value of $4.5 trillion. Nvidia alone lost about $229 billion in market value due to Trump’s statements.

Microsoft, which heavily invests in infrastructure to operate its cloud data centers, saw a market value decline of $85 billion. Online retailer Amazon lost $121 billion in value, while Tesla’s market value dropped by $71 billion.

Recommended for you

Exhibition City Completes About 80% of Preparations for the Damascus International Fair Launch

Talib Al-Rifai Chronicles Kuwaiti Art Heritage in "Doukhi.. Tasaseem Al-Saba"

Unified Admission Applications Start Tuesday with 640 Students to be Accepted in Medicine

Egypt Post: We Have Over 10 Million Customers in Savings Accounts and Offer Daily, Monthly, and Annual Returns

Al-Jaghbeer: The Industrial Sector Leads Economic Growth

His Highness Sheikh Isa bin Salman bin Hamad Al Khalifa Receives the United States Ambassador to the Kingdom of Bahrain